India's incubators are broken.

Thousands of Indian entrepreneurs and billions of rupees in economic growth have been lost to bad incubation.In July 2023, Shruti asked if I would like to speak at the upcoming Ideas of India conference. While the conference was studded with folks who had actually accomplished much, she felt (in hindsight, rightly) that despite my lack of similar professional accomplishment, I would be uniquely able to speak about parts of the startup story that were otherwise largely untold.

After some brainstorming, we agreed that the story of how India’s startup incubators are broken, how they fail founders, and how they can be fixed, was one that was worth telling.

I dedicated the following month to building a case, and was fortunate to have Pradyumna (an EV awardee, podcaster, and writer), assist me in compiling the data. The early data confirmed what I and many young, first-time founders had experienced in various incubator programs: most incubators are are broken, harmful to founders, and toxic to entrepreneurship.

The definition dilemma

There are over 1,000 "incubators" in India today. Tens of thousands of Indians, mostly young men and women who are either still in university or just out of university, attend these incubators every year.Reading through incubator scheme documents and interviewing incubation administrators, it becomes quickly apparent that the startup graveyard left in the wake of poorly-incentivized incubators is massive and entirely hidden.

The heart of the problem is that there is a definition mismatch between what incubation administrators think an incubator is, and what an incubator must be for them to be useful to founders.

The founder-side definition is quite straightforward: founders expect incubators to shorten time to Product Market Fit (PMF).

Think of finding PMF as you finally pushing a big boulder to the top of a hill. Once you get there, the rest of the journey still needs careful execution, but you have gravity to help on the way down. Gravity, in this case, is the fact that users are willing to pay for what you're selling. VCs and banks are interested in financing your operation, you can build Excel sheets, make projections, hire people, and actually build a business.

The vast majority of startups die between idea and PMF. This is where incubators come in. An incubator (as far as founders are concerned) reduces time to PMF.

Welcome to innovation by central planning.

The phrase 'Product Market Fit' appears zero times in any scheme document. Depressingly, this is not limited to government-backed incubators. Corporate and university incubators also do not take a founder-first approach.

Naive, first-time founders walking into these incubators see the effects of this central planning in 4 parts: selective capital, overuse of grants, opaque terms and broken incentives.

Selective capital

There is no ambiguity about why founders apply to incubators: they're seeking capital. Founders will attest to the fact that incubators can skip everything else — the office space, the mentorship, the 3D printing machine — but guaranteed capital must be non-negotiableCapital is proof that someone believes in your idea, and can buy you access to almost everything else. Money also lets you focus on starting up, instead of worrying about food and shelter.

Less than 1% of incubators in India offer guaranteed capital. The numbers are surprisingly the worst with corporate incubators who incorrectly think that the possibility of a purchase order is funding enough.

Founders go through an elaborate application and interview process to be accepted into incubators to then be told, “We believe in you, but not that much”. More time is spent filling forms and doing interviews to get financed after entering an incubator, than on building the business.

The road to hell is paved with good intentions. The well-intentioned incubator is worried that you, the founder, do not know how to correctly use what they consider to be their money. They want to coach you into entrepreneurship first.

The result, however, is that founders are forced to build the company their incubators want them to build, instead of the company their users want them to build, otherwise they do not get funded.

Founders are usually struggling to execute pilots, or build prototypes. Instead of being given a guaranteed cheque to go out and do those things, they’re given lukewarm replacements, like shared office spaces, or irrelevant advice from MBA textbooks.

Overuse of grants

The bulk of incubators that do conditionally offer money, disburse it as grants, instead of capital against equity. The majority of all financing in India’s incubators, thousands of crores of rupees, is grant-driven.Out of 147 institutes supported by the Department of Science & Technology, for example, only 91 claim to have some form of funding. Only 43 of those mention exactly how much they money they will invest. Of those, only 20 indicate what their funding terms are, and of those 20, only 5 offer exclusively equity financing.

To the untrained eye, grants sound great on paper. You’re giving founders free money, what could be wrong with that? Not taking equity in return for your investment, however, removes the primary incentive that most capital investors have: a return on investment.

Grants replace the keen eye of an investor with the guesswork a corporate employee or academic professor.

In the absence of ROI-driven incentives, the employees running these incubators end up being incentivized to pick ideas that are most academically exciting or those that will make for good newspaper headlines, instead of those which have the highest chance for commercialization.

Institutions who finance ideas via grants are philanthropic grant programs at best, and skill development centers at worst. They are not incubators, even if they choose to call themselves that. Incubators must release capital against equity, otherwise they have no incentive to pick and back the best founders, and the best ideas.

Opaque terms

Founders are walking into incubators blind. Our research across 1,000+ incubators has been able to find only 5 incubators that transparently share a downloadable copy of their financing terms agreement.How it works across incubators today is that the terms for the investment are negotiated upon between the incubator and the founder only after they get into the incubator, with no guarantees.

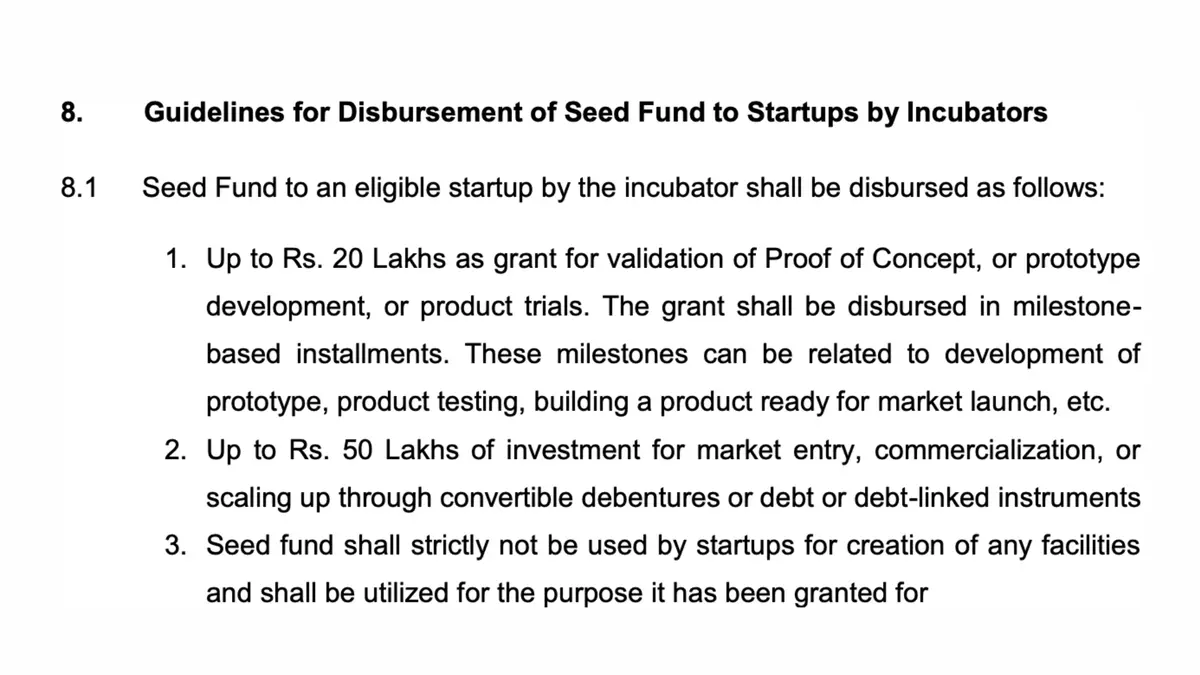

Almost all of these incubators are also mandated to release the money in milestones, instead of in one lump sum. This is a great example of sorts of bad ideas that lead to well-intentioned hellscapes. Ideas that are invariably the result of incubators being built and run by people who have never started a business themselves.

By definition, the early stage journey consists of unending pivots till you hit PMF. How can any milestones be defined? Founders across incubators will tell you stories of founders who, after receiving the first trance in grant funding, realized that their business needed to pivot, but stayed the course to get the remaining grant tranches.

Today, incubators are incentivized to be opaque and optimize for excess caution. As a consequence, founders are stuck accepting restrictive terms that they become privy to only after they get into the incubator.

Broken incentives

If you've made it this far, then this is next statement is going to be no surprise: the reason India's incubators fail founders, however well-intentioned, is that they do not have the right incentives.Here's a depressing fact: 17% of DST-backed Technology Business Incubators do not have a working website. We checked. These are supposed to be India's finest. And this is not counting those that have little-to-no useful information, or look like they were built in the 1990s.

Here's another: Less than 15% of DST-supported incubators have a tech entrepreneur mentoring the founders. You know, someone who has gone through exactly what they are going through. It’s usually a well-meaning professor, or ex-corporate employee who has never built a startup. Irrelevant advice kills more startups than no advice.

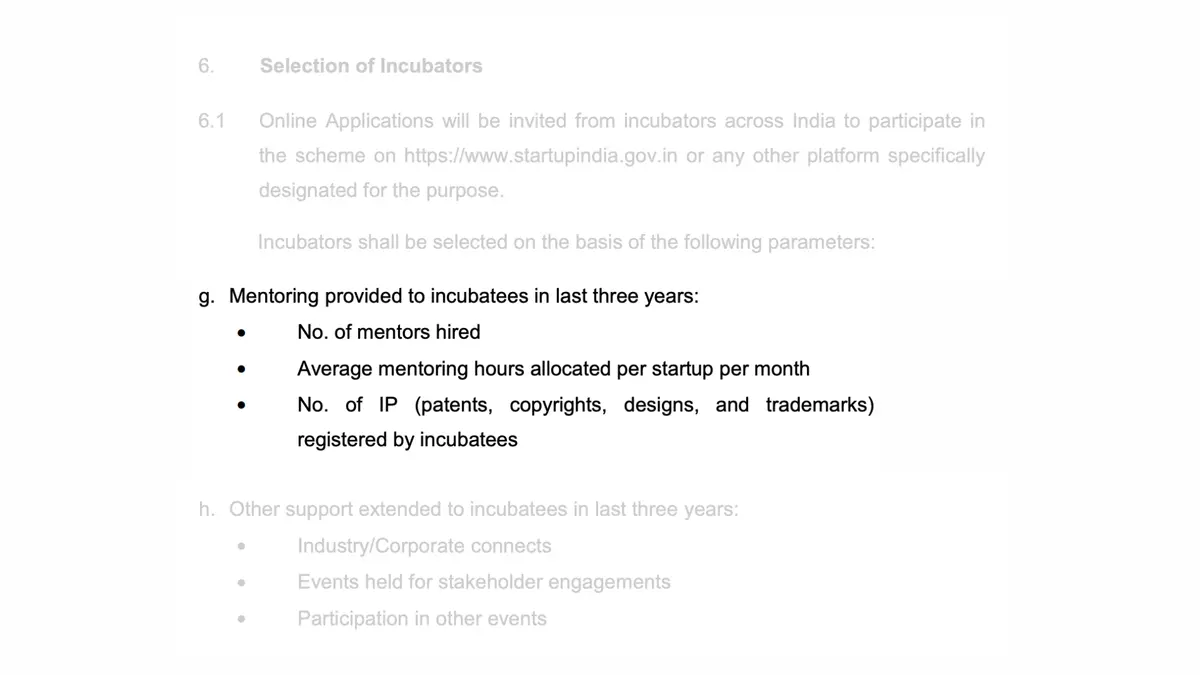

Without a return on investment as their north star, these incubators start using really weird and unrelated parameters to prove that they are doing well. And this is not their fault entirely, the hierarchy above them mandates it. Here’s an example of what the Seed Fund Scheme tracks:

Goodhart's Law perfectly summarises the problem:

When a measure becomes a target, it ceases to be a good measure.

Number of patents filed used to be a measure of inventiveness. It has now become a target for incubators to hit. The result is that incubators force founders to work on and file hundreds of useless, uncommercializeable patents each year, and that is regarded a success.

Engagement was earlier measured through the number of relevant experts mentoring the founder. This has now become a target, forcing founders to sit though hours of unnecessary lectures so that the incubator can hit its event quota and look good when they send back their reports.

The result is that everything looks peachy, but, thanks to broken incentives, most certainly isn't.

The consequence

The consequence is obvious. Founders in Indian incubators take more time to get to PMF, not less. Which means more startups die today compared to if we didn’t have incubators at all.How do we solve this?

Paul Graham, the founder of Y Combinator, writes in his blog on How to Fund a Startup:According to the National Association of Business Incubators, there are about 800 incubators in the US. This is an astounding number, because I know the founders of a lot of startups, and I can't think of one that began in an incubator.

What is an incubator? I'm not sure myself. The defining quality seems to be that you work in their space. That's where the name "incubator" comes from. They seem to vary a great deal in other respects. At one extreme is the sort of pork-barrel project where a town gets money from the state government to renovate a vacant building as a "high-tech incubator," as if it were merely lack of the right sort of office space that had till now prevented the town from becoming a startup hub. At the other extreme are places like Idealab, which generates ideas for new startups internally and hires people to work for them.

Whereas incubators tend to exert more control than VCs, Y Combinator exerts less. And we think it's better if startups operate out of their own premises, however crappy, than the offices of their investors. So it's annoying that we keep getting called an "incubator," but perhaps inevitable, because there's only one of us so far and no word yet for what we are. If we have to be called something, the obvious name would be "excubator."

Sounds frighteningly similar to India, doesn’t it? Until you realize that this was written nearly 20 years ago, in 2005. Today, almost two decades hence, it is no longer ambiguous what a good incubator program looks like.

India’s incubator model is outdated and needs to change. We need more excubators.

What policy-makers can do

- Exit incubation: Government bodies should not be involved in incubation. All that time and money is better spent making the space easier for private players to enter. For example, India has no simple, two-page convertible instrument for startups to raise money like the SAFE that does not rely on CCPS or need any intervention from lawyers and CAs. Private players cannot solve this without deregulation.

- Terminology is critical: We should consider seriously the terminology we use so that it is not misleading to founders. Grant programs, co-working spaces and skill development initiatives are immensely valuable, but we must label them accurately to prevent misleading founders searching for incubators.

What incubators can do

- Be selective: Low thresholds for admittance benefit neither the incubator nor the founder. A more selective process ensures that only startups with genuine potential are nurtured.

- Invest capital for equity: To align incentives properly, incubators should invest capital in exchange for equity. This return on investment model ensures that incubators are as invested in the startup's success as the founders themselves.

- Skip mentorship: Offer mentorship exclusively from experienced ex-founders. Irrelevant advice from non-founders is more harmful than no advice at all. No advice > irrelevant advice.

What founders can do

- Prefer angels to incubators: Angels are quicker to move, provide capital in exchange for equity, and are highly motivated to help you achieve PMF and beyond. Angels embody what incubators should strive to be.

- Be the invisible hand: Only choose incubators that offer guaranteed capital on transparent terms. By refusing to engage with subpar incubators, founders can pressure these institutions to improve their offerings.

- Transactional awareness: If you choose to join an incubator, remain aware of the system's flaws. Understand that incubators are transactional and approach the relationship with a clear-eyed perspective.

India's incubators are not intentionally evil or destructive machines. On the contrary, individually, each incubator member is likely to genuinely care. Many try to work around the system to help their startups. They would be the first people to agree with what I’m saying: thousands of founders and billions of dollars can be saved if we just aligned incentives better.

The original presentation used at the Ideas of India conference can be found here.